This isn’t about the 72 young boys waiting for a Religion of Peace suicide bomber. Instead, we’re enjoying a little diversion that tests a popular maxim, the investing Rule-of-72.

Why the frivolous detour? The Railer’s head is about to explode with all the recent insanity. Douchebag Attorney General Garland, the vengeful weasel who says that parents at a school board meeting are domestic terrorists, raided Trump’s home in a shady political reprisal. “The men and women of the FBI and the Justice Department are dedicated, patriotic public servants.” Garland drones. Nope. Rank and file folks may fit that description, but their leadership is corrupt. The Railer and similar minded millions don’t trust them.

A big, fat, tatted, trust fund brat and fraud named John Fetterman, whose already low IQ hasn’t been helped by a recent stroke, leads the Pennsylvania Senate Race. He fancies himself a hoodie wearin’ blue collar dude. Nope. Besting Comrade Bernie, he’s never worked a real job in his life, living into his 50’s off his wealthy parent’s charity. He also has a fetish for releasing convicted murderers.

A review of Fetterman’s tenure on the board (of Pardons), meanwhile, shows that the Democrat has voted to release an array of violent criminals jailed for their roles in brutal murders…

His Republican opponent, Dr. Mehmet Oz, is a smart, accomplished, hardworking, son of immigrants. He’s a retired heart surgeon, a popular television teacher, a smart communicator. Polls say Oz is trailing the bum who can’t form a complete thought or sentence. What’s wrong with you people in Pennsylvania?

The Center for Transgender Medicine and Surgery at Boston Medical is adding and removing children’s breasts, penises, vaginas, and uteri. Nazi Doctor Josef Mengele was hunted for decades after committing medical atrocities at Auschwitz. Like Mengele’s occasional survivors, these mutilated children will never know a normal life.

And with inflation raging at near half-century highs, Washington Demonrats say the solution is another trillion dollar log on the inflation bonfire. Instead of sending firefighters, Dems are raising a clone army of nearly 100,000 armed IRS agents. Expect hack Lois Lerner to return from exile to supervise them. Before suffering amnesia that won her a contempt of Congress, Lois focused her agency’s partisan harassment on the evil deplorables. Now she, or someone just like her, will have a new, massive, privateer force at their command.

The Railer needs a break.

Let’s turn to some lighthearted fun instead. While chatting about Bidenflation and its effect on prices with his brilliant progeny, The Railer brandished the Rule-of-72. That rule-of-thumb says that a price or investment will double in 72 divided by the interest rate. Example: one dollar in a 5% investment will be worth two dollars in about 14 years.

72 divided by 5 is about 14, or, 5 times 14 is about 72. Bam!

That is a super easy way to get an approximate answer to common growth rate questions. But how good is the Rule-of-72? Is it true, and if so, how accurate? Thankfully, this is a simple question to answer and yes, it is a surprisingly good.

The Railer is an engineer so let’s do some simple math. We want to solve:

I Y = 2

Where I is the annual growth rate and exponent Y is the number of years.

Given I, how do we solve for Y? Let’s take the logarithm of both sides.

Y * Log(I) = Log(2) or Y = Log(2) / Log(I)

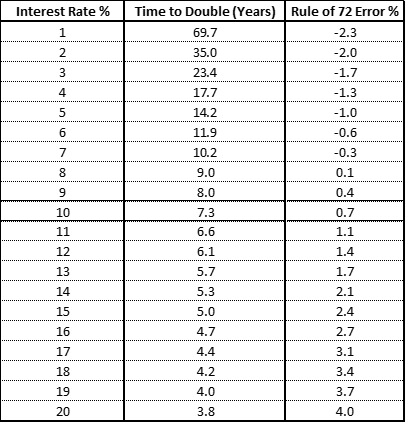

Running this calculation in a simple Excel spreadsheet:

The first column is our annual interest/growth rate, the second is the time it takes to double, and the third column shows the error, the difference between the Rule-of-72 and actual.

Our venerable rule is quite good. For rates between 1% and 14%, the time error is about 2%. At 1% for example, our Rule-of-72 says, well, 72 years. The actual time is 69.7 years. That’s pretty good. Near 8% the Rule-of-72 is almost exact. That is especially nice. Normal economic times set interest and inflation discussions in the low to mid-single digits.

Let’s consider an extreme example. What happens when you stop making payments on that 28% annual rate credit card? Rule-of-72 says your balance will double in about 2.6 years, or 31 months. The actual time is a little under 34 months. That should act as a warning to all. High credit card debt is a difficult trap to escape. CNN says that:

Over the past year, credit card debt has jumped by $100 billion, or 13%, the biggest percentage increase in more than 20 years.

Alternate headline: Bidenflation hits American’s wallets and purses.

Most Americans were born after our last bout of double-digit inflation. Lyndon Johnson’s wars on poverty, Vietnam (we lost both), and his creation of the welfare state lit that inflation fire. A little more than a decade later, Republican Reagan put it out. Like Johnson, President DimJoe Xiden and his insatiable Demonrat Party have made high interest rates relevant again. Those old enough to remember the 70’s can revisit the joys of rising prices, static paychecks, recession, and inflation fueled taxes on our shrinking investments. Should today’s 10% inflation rate endure, costs will double in just the next 7 years. Did ya catch that? That’s the Rule-of-72 at work.